The Thomson Reuters Foundation, Refinitiv, International Sustainable Finance Centre (ISFC), Robert F. Kennedy Human Rights, White & Case, Eco-Age and The Mekong Club have partnered to emphasise the importance of the ‘social’ dimension of Environmental, Social and Governance (ESG) investment criteria for investors and advance the dialogue toward practical, relevant and comparable ESG ratings.

Environmental, Social, and Corporate Governance (ESG) indicators refer to the three central factors in measuring the sustainability and societal impact of an investment in a company or business. These non-financial metrics are used as part of an analytical process to identify material risks and growth opportunities:

- Environmental criteria consider how a company performs as a steward of nature

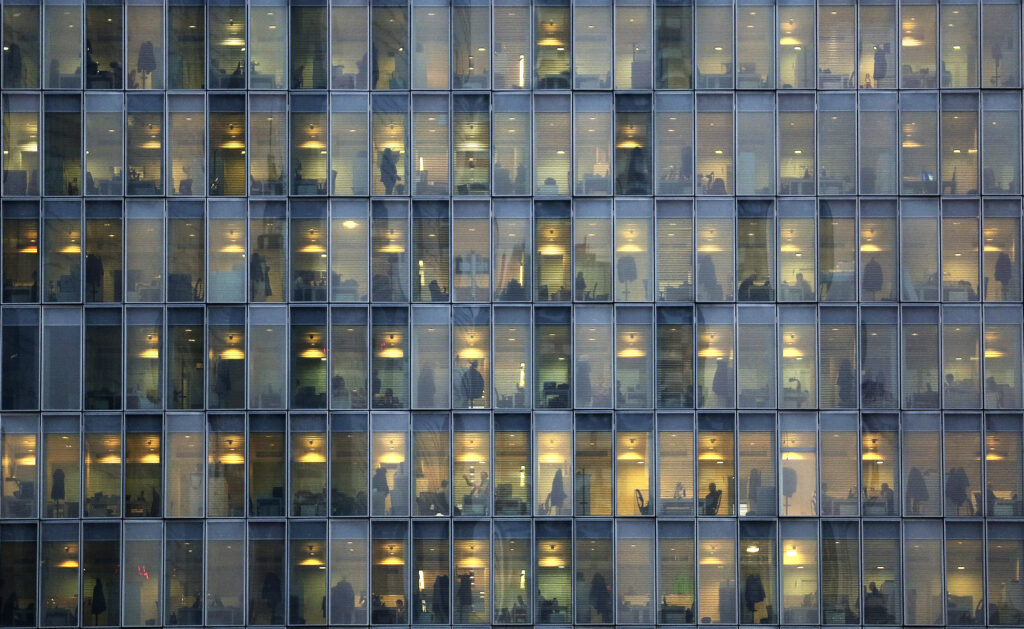

- Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities in which it operates

- Governance criteria deal with a company’s leadership, anti-corruption mechanisms, internal controls, and shareholder rights

In practical terms, the ‘S’ in ESG criteria focuses on human rights issues relevant to business, including modern slavery, child labor, land rights, inequality, diversity, employee relations, health and safety, privacy, and human capital management.

A study by the Harvard Kennedy School states that the ‘S’ is “seriously under-conceptualised and fails to draw on substantive and procedural human rights standards”. This under-conceptualisation, coupled with the existing numerous approaches to defining the ‘S’, makes engaging with such criteria overwhelming for investors and companies. This, in turn, makes it difficult for them to integrate these metrics into their processes.

In the wake of COVID-19, social factors are gaining more attention and will be of growing importance for improved economic and societal resilience. Issues such as workers’ rights in global supply chains have been catapulted into the spotlight. Interestingly, as the COVID-19 pandemic began to unfold amid plunging stock markets, ESG investments fared better than the overall market. In the future, companies will need to have a better understanding of how to address the ‘S’ in ESG criteria. As trillions of dollars are being poured into economies through stimulus packages, there is both a need and an opportunity to ensure that respect of human rights is an integral part of how we rebuild the new normal.

All partners, alongside the UN Principles for Responsible Investment, who are participants in the working group*, believe in amplifying the message that ‘S’ indicators are crucially important – and that there is a need for broader and speedier adoption globally. Working with other organizations will be key to bringing attention to this important topic, and to ensuring that the global conversation moves forward. The working group does not claim to provide a comprehensive framework; instead, it aims to advance the dialogue around how investors can better integrate the ‘S’ indicators into their investment models in line with existing frameworks. Such frameworks include the United Nations Guiding Principles on Business and Human Rights, the Organisation for Economic Co-operation and Development (OECD) framework, as well as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) standards.

Ultimately, the working group aims to (i) widen the adoption of impactful ‘S’ indicators by investors and asset managers using data, and (ii) engage in dialogue with different players to both identify key indicators that have a clear impact and show how these can be best adopted and streamlined by investors.

By strengthening the ‘S’ metrics in ESG criteria and engaging the financial sector, businesses, the legal community, policymakers, civil society, consultancies and social enterprises, the working group aims to foster approaches and models that consider economic and social justice, alongside environmental sustainability. This multi-stakeholder approach aims to offer a new impetus for both improving the ‘S’ indicators and strengthening them to promote more frequent use.

The COVID-19 pandemic has exposed the fragility of our socio-economic systems. However, it has also created an opportunity to rethink existing approaches to how business and investing are conducted, and build more inclusive, resilient and fair societies.

* The PRI are interested in developing the conversation around the ‘S’ indicator and alignment with the UN Guiding Principles. The PRI is not participating in the creation or development of indicators, which will form a key part of PRI’s efforts over the next 3 years.

More News

View All

The authoritarian playbook in action: Insights from Trust Conference 2025

Learn our Acting…

Read More

Antonio Zappulla Trust Conference Opening Remarks: 22nd October

View our CEO Antonio Zappulla’s opening…

Read More

Antonio Zappulla Trust Conference Opening Remarks: 21st October

View our CEO Antonio Zappulla’s opening…

Read More

Trust Conference 2025: Disinformation, lawfare and aid cuts — Civil society’s fight for survival

Trust Conference, the annual flagship forum hosted by the Thomson Reuters Foundation,…

Read More

Professor Can Yeğinsu joins Thomson Reuters Foundation Board of Trustees

We are delighted to…

Read More

Top priorities for Just Transition in Bangladesh

In one of the world’s most climate-vulnerable countries, a just…

Read More

AI Company Data Initiative drives transparency on corporate AI adoption

Now open for company…

Read More

Winners of the 2025 TrustLaw Awards Announced

This week marks the announcement of the 2025 TrustLaw Awards winners,…

Read More

How the Foundation is supporting LGBTQ+ communities worldwide

Over the last year, the Foundation has…

Read More

World Press Freedom Day: the need for the equitable and ethical adoption of AI

AI will be…

Read More